crypto tax accountant canada

If youre getting irrelevant result try a more narrow and specific term. Some jurisdictions may be much stricter than others so you ought to always consult with an accountant specialist who will help you figure out some of the subtler details of how crypto tax law works in your country and if there are any exceptions or special rules for Binance tax reporting as a whole.

Crypto Currencies Reporting And Taxation Maroof Hs Cpa Professional Corporation Toronto

It will break down the tax categories you could fall into.

. Crypto Tax Software and Cointracking Calculator. If youre getting few results try a more general search term. Koinly combines crypto accounting and tax all in one software package.

Calculate Bitcoin and crypto taxes of capital gains and income for Bitcoin Ethererum and other crypto-currencies from trading spending donations tipping and mining. LOOKING FOR A TAX ACCOUNTANT. FULL TAX PREPARATION SERVICE.

These arent just generic files being generated either. To use a crypto tax calculator you should understand the basics of how crypto tax is calculated. CoinTrackers crypto portfolio calculator and crypto tax software has helped over 10000 users file their taxes on over 1 billion in crypto assets.

Of these 326 used a tax software approved by the CRA for NETFILE 582 used an EFILE service and 02 of filers used File My Return. This page will detail trading tax rules laws and implications. Most countries require you to calculate what your crypto was worth at the time of purchase and the time of sale in terms of the local fiat to calculate taxes.

Day trading taxes in Canada certainly support that statement and you cant join the likes of top Vancouver trader Jeff Pierce without first tackling the tax demon. YOU ARE A TAX ACCOUNTANT. The best tax software in Canada helps you maximize your refund and many even allow you to file your taxes online for free.

It will discuss asset specific taxes before concluding with top tax tips for the savvy day trader. Since bitcoin is decentralized there is not much they can do to it but centralized services like exchanges are an easy target. You can easily generate crypto tax reports and track your crypto portfolio with ZenLedger.

The UI is one of the best in the crypto tax field and in addition to handling tax reporting for the US Australia and Canada it also supports tax reporting for more than 20 other countries. ZenLedgers platform helps crypto investors and tax professionals with crypto tax filings and financial analysis by providing a digital workflow to simplify optimize and automate the tax and accounting process. Crypto has grown large enough for the regulators to pay attention to it and slowly but surely contain some of its aspects.

This led to an exodus of many unregulated crypto exchanges from the USA and the ones left are all registered and in. A whopping 91 of Canadians who filed tax returns in 2021 did so by using electronic filling methods. The easiest most secure and most accurate way to get your cryptocurrency taxes done is with CoinTracker.

People who searched for Accountant jobs also searched for book keeper audit senior tax associate budget analyst tax manager assistant controller tax preparer staff auditor tax analyst audit assistant. Binance Tax Documents and Forms. These are actual.

Founded in 2017 and built by industry veterans in technology finance and. From there you calculate taxes on your profits just like any other capital gain tax would be.

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Successful Accountants Tax Plan For Cryptocurrency Corvee

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

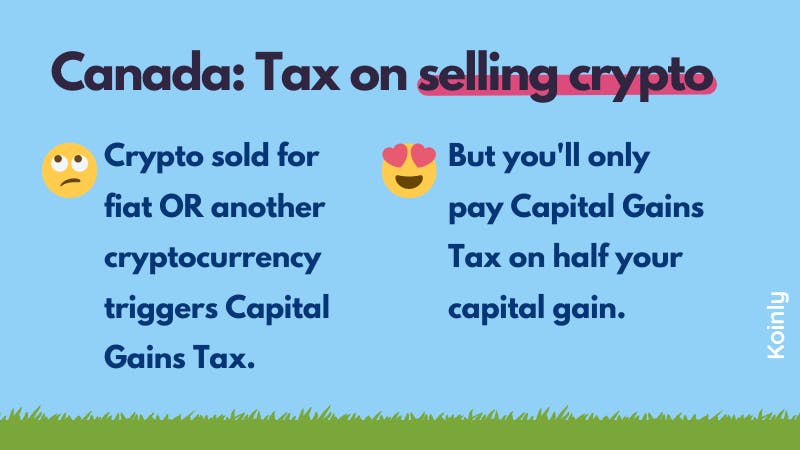

The Ultimate Canada Crypto Tax Guide 2022 Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

The Ultimate Canada Crypto Tax Guide 2022 Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Cryptocurrency Taxes In Canada Cointracker

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Koinly Review Is It Good For Canadians March 2022 Updated

Crypto Tax Accountant Canada Filing Taxes

Crypto Tax Reporting Tools For Accountants Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

How To Declare Cryptocurrencies On Your Taxes In Canada By Iskender Piyale Sheard Medium

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax