do pastors get housing allowance

Furthermore this housing allowance can extend into a ministers retirement plan. According to the IRS the housing allowance of a retired minister counts because it is paid as compensation for past services.

10 Housing Allowance Tips For Ministers What Ministers And Churches Need To Know Housing Allowance Irs Taxes Allowance

Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020.

. The payments officially designated as a housing allowance must be used in the year received. The amount that a minister can utilize for their housing allowance varies depending on their housing circumstances. Individual Income Tax Return or Form 1040-SR US.

One of the greatest financial benefits available to pastors is the housing allowance exemption. Traveling evangelists who are ordained ministers are eligible to take a housing allowance from the money given to them by churches located away from their home community. The intent of congress was to encourage clergy to spread the good news and in hopes that the effect of the good news can penetrate the population.

The housing allowances for each are NOT included in income when the pastors figure their income tax liability and housing allowances ARE included in income when heshe figures their Social Security Tax liability. Some pastors choose a 30-year mortgage over a 15-year one because their mortgage payments will provide them with a larger housing allowance over 30 years instead of 15. The bad news is that by choosing a 30-year mortgage instead of a 15 theyll also pay thousands more in interest for their house.

That means that if you only work ten hours a week at the church then you cannot claim a 50000 housing allowance. My software system cant generate payroll unless there is salary so I enter in 1 for salary each pay period in order to generate the housing payment. Thats helpful to know because if you hear of a pastor with a 50k housing allowance that does not mean that he spends that much a year on his house.

I think a part time minister receives the entire housing allowance so long as the rest of the rules are followed. There are two ways pastors are paid housing allowances. The minister must include the amount of the fair rental value of a parsonage or the housing allowance for social security coverage purposes.

In this situation that extra 1000 has to be included as part of your wages on line 7 of your Form 1040 US. According to Christianity Today 81 of full-time senior pastors take advantage of the housing allowance. They would be taxed on salary minus living expenses.

Regretfully the clergy has a. A housing allowance amount can be amended at any time during the year. A housing allowance is often a common and critical portion of income for pastors.

Tax Return for Seniors. So when you take them out in retirement they are still considered eligible pastoral income. For example suppose a minister has an annual salary of 50000 but their total housing allowance is 25000.

So if youre receiving 5000 in a housing allowance and the fair market rental value of the home dips to 4000 you can only exclude 4000 from your gross income. The ministers cash housing allowance and parsonage allowance. This comes in two forms.

So if a pastor earns 80k a year he could designate that 50k or whatever of that as a housing allowance. This comes from Revenue Ruling 64-326 which allows for the housing allowance of an ordained minister to be paid by multiple churches. A housing allowance is often a common and critical portion of income for pastors.

So this can be used for mortgage qualification even though it does not show on tax returns. It may not encompass expenses incurred as the result of commercial properties or vacation homes Any items for inclusion must be personal in nature for the. Why do pastors get a housing allowance.

Often there is the sound of frustration and. The church board can designate a higher housing allowance amount at any time during the year but it cant designate it retroactively on any income that has already been paid to the minister. Therefore housing allowance is not reported as taxable income on the personal tax returns.

Regretfully the clergy has a difficult time getting qualified for a mortgage loan. Most ministers shouldnt pay off their houses. Again both pre-tax accounts have the same balances at retirement as Scenario 1 because the accounts have not been taxed.

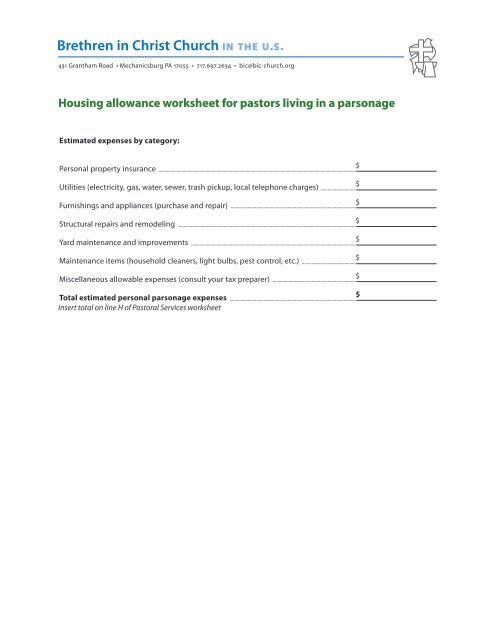

Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040 US. Some churches have a parsonage a house for the pastor owned by the church and the pastor lives in that. A housing allowance may include expenses related to renting purchasing which may consist of down payments or mortgage payments andor maintaining a clergy members current home.

Contributions you make to a church retirement plan usually a 403 b 9 as a pastor are a part of your pastoral income. Housing Allowance for Pastors. Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services.

Other churches simply pay the pastor a housing allowance as part of his salary. Individual Income Tax Return. For example an executive pastor making 75000 who lives in a one-bedroom apartment would have a smaller housing allowance than an executive.

In addition this is saving pastors a total of about 800 million a year. I can then do an adjustment at the end of the year for the minister to put it all into housing. First the IRS looks at the pastor housing allowance income as an exclusion from income.

He could have conceivably designated his entire salary to be toward housing. The Roth however now has a balance of 283371 at retirement 3632961 less than in Scenario 1. These allow ministers of the gospel to exempt all of their housing expenses from federal income taxes.

It is a form of income to fully pay or at least allow a part of the expense to own or rent a home. That can be worth quite a bit of money so who. I dont think the IRS would consider 100 an hour reasonable compensation for your service.

Social Security Coverage The services you perform in the exercise of your ministry are generally covered by social security and Medicare under the self-employment tax system regardless of your status. All Salary as Housing Allowance. Housing Allowance in Retirement.

So if a pastor earns 80k a year he could designate that 50k or whatever of that as a housing. It is a form of income to fully pay or at least allow a part of the expense to own or rent a home. It should be at the option of ALL pastors whether to have income taxes withheld from their pay each pay period.

I want the w2 for all my employees even ministers with only housing allowance. Using pastoral housing allowance as income to qualify for a mortgage. Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

Enter Excess allowance and the amount on the dotted line next to line 1. The housing allowance for pastors is not and can never be a retroactive benefit.

Ultimate Guide To The Housing Allowance For Pastors Reachright

Top 5 Faqs Regarding Minister S Housing Allowance Baptist21

Ministers Housing Allowance Open Bible East

Humble Advice For The Passive Pastor In The Parsonage Sbc Voices

Why Do Pastors Get A Housing Allowance The Cripplegate

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

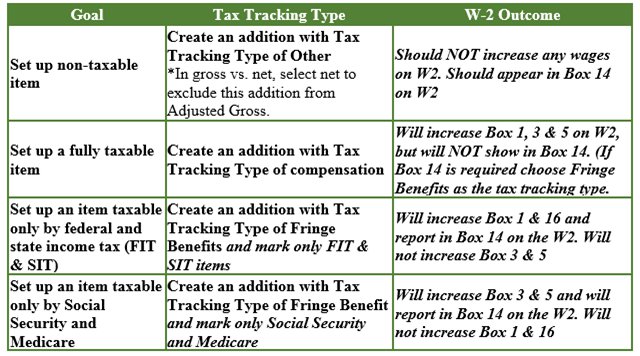

Payroll Set Up Housing Allowances For Clergy Members Insightfulaccountant Com

Video Q A Changing Your Minister S Housing Allowance The Pastor S Wallet

Minister S Housing Allowance Basics Church Accounting Series Youtube

Housing Allowance For Evangelists

Understanding The Housing Allowance For Ministerial Staff

Ministers Housing Allowance Open Bible East

What Is A Minister S Housing Allowance Who Qualifies

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga Goodreads

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Pin On A Community Of Christian Encouragers Group Board

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet